The idea behind microfinance is that providing small-scale financial services to people who don’t have access to traditional banking can lift them out of poverty. Muhammad Yunus pioneered the field when he opened Grameen Bank – and won a Nobel Peace Prize in the process. The nonprofit organization Kiva facilitates crowdfunded microloans to entrepreneurs in developing countries. And now RaiseMe is enabling high school students to earn micro-scholarships.

The concept is breathtaking in its simplicity. It’s well known that colleges reward good grades and extracurricular activities, but there’s never been a way to quantify what colleges value. With RaiseMe micro-scholarships, colleges can attach a dollar amount to every imaginable activity. More than 250 colleges have signed on to RaiseMe, and offer students varying amounts of money for their achievements.

How RaiseMe Micro-Scholarships Work

Here’s how it works. A student signs up for an account, selects colleges, and then enters grades and activities into their portfolio. The student can see a running tally of how much they’ve banked in scholarships for each of their selected colleges. Whitman College in Walla Walla, Washington, for example, offers $750 for perfect attendance, $500 for each honors course, and $10 for every hour of community service. Meet with a Whitman College representative at a college fair, and that’s another $500.

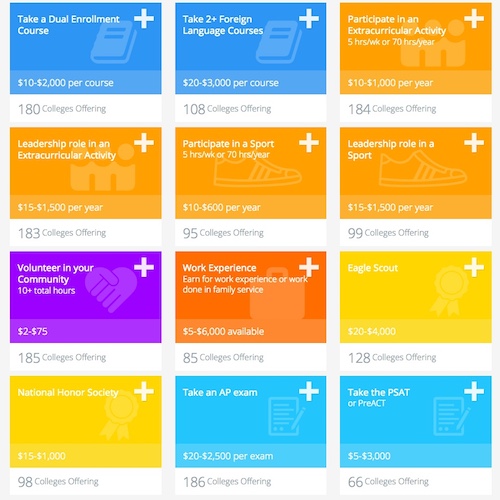

Arizona State University kicks in $8 for every hour of community service, $1,000 for each AP or IB course passed with a C or better, and $2,000 for an ACT score of 24 plus $1,050 for each additional point. Other schools offer RaiseMe micro-scholarships for participating in a sport, being an Eagle Scout, work experience, taking the PSAT, leadership experience, and more.

Once students register with RaiseMe, they can backfill their portfolios. In other words, a high school senior can register and then obtain micro-scholarships for activities in their freshman, sophomore, and junior year. Once a senior applies to and is accepted by one or more of the RaiseMe colleges, their accumulated RaiseMe funds are included in the college’s financial aid award letter.

It’s important to note that the RaiseMe micro-scholarships are typically deducted from any other institutional scholarships the student receives. For example, if a student were awarded a $10,000 chancellor scholarship from a college and had accumulated $2,500 in RaiseMe funding, the chancellor scholarship would be reduced by that $2,500.

Who’s Behind the Curtain?

A critical question to ask is, Who’s behind RaiseMe? The company, which is privately held, was founded in 2012. After financing by venture capitalists, RaiseMe launched nationwide in 2014. Since then, the company has caught on like wildfire among both students and funders. In March 2017, the company raised another $12 million in venture capital. The site has also captured the imaginations of college recruiters who want a new marketing vehicle.

RaiseMe micro-scholarships were built on a captivating idea, and supporters say that it’s a way to incentivize students to do well in school and persevere throughout their high school careers. Detractors point out that RaiseMe scholarships aren’t extra money; it’s money that the school would have awarded the student upon application anyway.

Unintended Benefits

Both arguments can be true, and not take away from the value of RaiseMe. Even if a student doesn’t matriculate to a participating college and never collects a dime, RaiseMe is an excellent way to track achievements and activities throughout high school. Many external scholarships require the kind of granular information that is contained in a RaiseMe portfolio, and encouraging students and families to record that information and keep it in one place is valuable.

The other unintended benefit of RaiseMe is that students can get on the radar of participating colleges. In today’s competitive environment, the importance of being noticed can’t be overstated. Because students can select colleges, it’s also a great way to demonstrate interest. You can read about the importance of demonstrated interest in college admissions here.

At the end of the day, there’s no downside to RaiseMe. It shows students that their work has both intrinsic and extrinsic value, and provides a concrete example that college can be financially attainable. That can fuel students’ dreams, and you can’t put a price tag on that.

[Update 3/5/18: RaiseMe contacted ScholarshipMoneyOnline disputing the following statement in the article: “It’s important to note that the RaiseMe micro-scholarships are typically deducted from any other institutional scholarships the student receives. For example, if a student were awarded a $10,000 chancellor scholarship from a college and had accumulated $2,500 in RaiseMe funding, the chancellor scholarship would be reduced by that $2,500.”

The RaiseMe Communications Manager, Cecilia Xia, wrote, “This isn’t the case — RaiseMe micro-scholarships tend to represent the guaranteed minimum that a student would be eligible to earn from an institution upon acceptance, so there would be no reduction in institutional aid — simply a match (and in some cases, students will earn more from the institution than their RaiseMe micro-scholarships account for).”]

Want more info and tips about college scholarships? Subscribe to the Scholarship Money Online newsletter.

Leave A Comment